This website is made possible by readers. I may earn a small commission when you buy through the links in this article at no extra cost to you. Learn more.

You might have heard of Furusato Nozei, but what is it really? And why is it something you should know? I wished I had heard about it sooner as I only started last year.

So, for those who just moved to Japan, this guide is so that you can not miss out on one of the unique tax exemption programs ever.

Disclaimer I am not a tax professional; therefore, this is not advice. Any instructions you follow here is at your own risk. I have only done Furusato Nozei a few times so far but intend to do it for many years to come. Please do your own research.

What is Furusato Nozei?

It is a system where you can make donations to municipalities of your choice. And the government will reduce the donation amount from your tax. So, technically speaking, you are paying your taxes in the form of a donation in advance.

Let's assume that you make 4,360,000 yen per annum, which is the average annual salary in Japan. Ignoring any other exemptions, the amount of residence tax that a person living in Shibuya, Tokyo, would have to pay is 264,200 yen for that year.

So, if you made 4,360,000 yen in 2021, you would have to pay 264,200 yen worth of taxes in 2022. You will be able to deduct part of the 264,200 yen with Furusato Nozei donations done in 2021.

According to this simulator, you can essentially make 66,995 yen worth of donations in 2021 and will have that amount reduced from the tax you have to pay in 2022. Note that the deduction will happen from June of the following year or June 2022 in this example.

I use the word “deduction” throughout this article, but technically speaking, it's not a deduction, since you don't pay less taxes. Rather, it's a redistribution of your taxes to other places.

Apart from getting karma, what is the point of replacing taxes with donations if you are going to pay the same amount anyway? Well, it's because, with each donation, you get a “thank you gift” from the municipality you donated to. There is a wide range of gifts, from A5 Wagyu Beef to Sapporo Beer.

Is Furusato Nozei free?

Furusato Nozei is not free. It costs 2000 yen per year.

This used to be an ad.

But no one likes ads, so I got rid of them. If my articles helped you, I ask for your support so I can continue to provide unbiased reviews and recommendations. Every cent donated through Patreon will go into improving the quality of this site.

Paying 2000 yen means that if you donated 60,000 yen, only 58,000 yen would be deducted from your tax.

There is a rule that the gift has to be less than 30% of the donation amount. So, if you donated 60,000 yen, you will get gifts worth up to 20,000 yen. Not a bad deal for a 2000 yen out-of-pocket cost.

Almost-free gifts? I'm in. What do I need to do?

How to Furusato Nozei?

1. Figure out your donation limit

First of all, you need to figure out how much you can donate. This depends on how much tax you will incur, which depends on your income. Apart from income, other tax exemptions affect the limit.

So, go ahead and use a simulator like this to get an idea of how much you can donate. According to it, with a salary of 4,360,000 yen with no other income or deductions, you can make 66,995 yen worth of donation.

This figure is, of course, to be used as a guide as many factors determine the amount of taxes. I donate about 80-90% of that suggested amount to prevent exceeding the limit, should there be any factors I am not aware of.

Just remember, any amount you donate above your limit will not be deducted. If your limit is 30,000 yen and you donated 40,000 yen, then you have donated 10,000 yen out of the kindness of your heart. Only 30,000 yen, minus the 2,000 yen fee will be deducted.

2. Choose a platform and make donations

Think of it as shopping. You need a platform to “shop” for these gifts. I use Rakuten, but there are other options like Satofull, Furusato Choice, or Tsustuura.

I designed a thing.

I found a 100 year old company that would create these heirloom quality canisters for me. They are handmade and will keep your tea leaves, coffee beans or anything that you need dry for years to come.

or read review

Unfortunately, English options do not exist.

It works the same way as shopping too. You browse the site based on gifts you want to receive and add them to your cart and check out. Like shopping, you can use your credit card and even get points.

Here are some of the gifts I donated in the past

- A case of 500ml Sapporo Beer (20,000 yen)

- 3-Bottle Whiskey Set (19,000 yen)

- 1kg of Jumbo Scallops (12,000 yen)

- 1kg of Giant Prawns (10,000 yen)

- 1.1kg of A4-5 Rank Wagyu Beef (10,000 yen)

Note that the date of donations is deemed based on the following

- Credit Card – Day payment is completed

- Bank Transfer – Day transfer by indicated bank account has been completed

- Payment Handling Slip (払込取扱票) – Day transfer by indicated bank account has been completed

- Registered Cash Mail (現金書留) – Day cash has been received by the municipal

Then the municipality will send you the gift.

The main difference with conventional shopping is that the gifts are often seasonal, so they might take a few weeks and even months to arrive. The expected delivery date will be stated on each product page.

There are few important things to note in this step

- If you choose to donate to the municipality you reside in, you will not get the deductions.

- Your registered name and address have to match your residence record. Alias name is fine. But if they are different, you will not get the deductions. Your delivery address, however, can be different.

3. Report the donations

The tax office needs to know that you made these donations; otherwise, they won't get deducted. There are two ways to do this.

One-Stop System

The first and easiest way is to use the Furusato Nozei One-Stop system (ふるさと納税 ワンストップ特例制度).

As one can imagine, filing a tax return in Japan can be pretty tedious. The One-Stop system is aimed at those who do not have to do so. For example, salaried workers whose companies file taxes on their behalf.

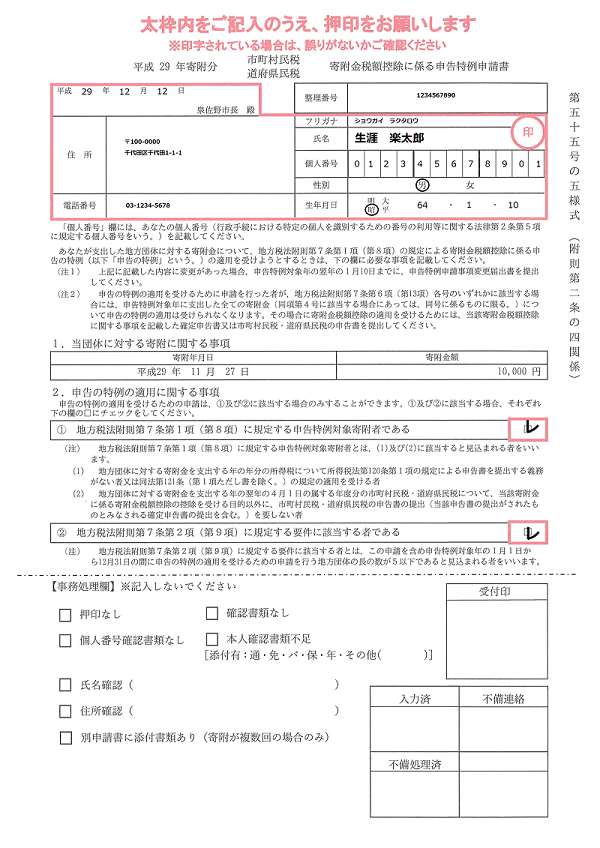

When you donate, there will be an option before you check out to choose if you want the One-Stop form (特例申請書の送付を希望). If you select yes, the municipality will send you the form with a return envelope (prepaid most of the time).

This is how the form looks like, although, most of the information would have been filled up based on your details used in the order. You just have to hanko or sign it.

You have to write your My Number, paste front and back copies of your My Number card, check the boxes acknowledging the terms, hanko or sign it, and send it back before Jan 10th of the following year (in principle).

There are conditions for this.

- You can only use this system if you donated to five municipalities or less.

Ie. If you donated to get five different kinds of gifts from Yaizu City, then it will count as one municipality. - You have to submit the form for each donation you make.

Even if it's to the same municipality or even a repeated order. - You do not file a tax return.

For example, if you are applying for a home loan deduction, you need to file a tax return in the first year. You can't use the system if you have to file a tax return, and instead, you have to fill up the relevant fields in your tax return.

If you send in the one-stop forms anyway, the tax office will invalidate them after your tax filing has been completed, and they will use the information on the tax return.

Manual Tax Filing

The second way is to file a tax return (確定申告) after the end of the year. In the form, there will be fields for you to input the donations. The necessary information are

- Date of donation

- Sum of donation

- Municipality donated to

You also have to include the certificates of donation (this is optional for e-filers), which the municipality will send to you for each donation you make.

The fields required make it seem easy, but it gets confusing when you make many donations and refer to each certificate.

How does deduction work?

There are three different ways deductions are done, depending on the way you report it.

Sole proprietorship (個人事業) tax filing

- Upcoming income tax will be less

- Upcoming residence tax will be less

Company employee (サラリーマン) tax filing

- You will be refunded from the income tax you paid via bank transfer.

- Upcoming residence tax will be less

One-Stop System

- Income tax is unaffected (full amount is deducted from residence tax)

- Upcoming residence tax will be less

How can I confirm if the donations have been deducted successfully?

For the first year, I was worried that I've made a mistake somewhere in this process and donated for nothing (apart from supporting my favorite municipality, of course).

As mentioned, depending on the type of filing, the deductions will happen on either your residence tax only or both residence and income tax.

Checking Furusato Nozei deductions on residence tax

For residence tax deductions, you can conveniently check it from the Notice of Resident Tax Decision (住民税決定通知書), which is a slip your municipality will send to you at the beginning of June each year.

In the summary (摘要) box, it will show the deductions.

This amount should be the total amount you donated (or the part that is deductible from your residence tax), minus 2000 yen for the fee.

In the case, you find that it does not show the full amount you donated, it could be because a part it has been deducted from your income tax, based on the way you file.

Checking Furusato Nozei deductions on income tax

If you did manual tax filing (確認申告), then part of the deduction will be from your income tax. Confirming the deducted amount on income tax is a little less straightforward.

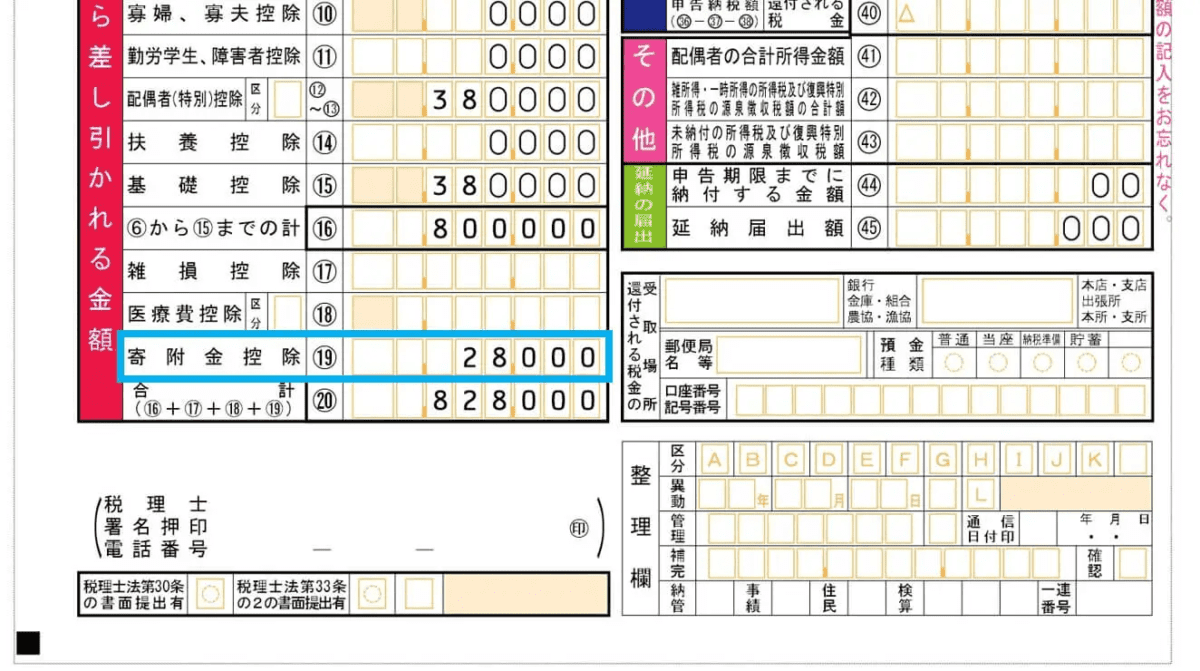

First, at the time of tax filing, confirm the amount of donations that will be deducted. It will be under a Donation Deduction row (寄付金控除) in the summary page.

Since this is simply the full deductible amount, you need to do some calculations to get the deductible amount from just the income tax.

The formula is

(Furusato Nozei Donation Amount – 2000 yen) x Income Tax Percentage

Since we know the Furusato Nozei Donation Amount from the tax filing, we are missing one part; the Income Tax Percentage. This depends on your income bracket and you can find it from this article.

Finally, calculate the deducted amount of income tax

Now that you know your income tax percentage, you are ready to finally calculate the deducted amount.

So in this case, if you donated 28,000 yen and manually filed as a company employee, the deduction from your income tax is

(28,000 – 2,000) x 10% = 2,600 yen

The tax office will transfer this amount to you via the bank details you entered during tax filing. The rest of your donation amount, minus the 2000 yen fee, should be deducted from your residence tax.

ie. 28,000 – 2,000 – 2,600 = 23,400 yen will be deducted from your residence tax.

Who is Furusato Nozei NOT for?

Since there is a 2,000 yen cost, it might not be beneficial if the value of gifts sent to you is just a little more than the cost of doing it. This is especially relevant to those with annual income of 2-3M yen.

Here's an example.

A company employee with a 2M annual income, whose wife is a housewife (therefore, with dependency deduction).

His allowable donation limit is about 7,000 yen, which means the value of the gifts will be approximately 2,100 yen. Since 2,000 yen is the fee and will not be deducted, it means he is paying 2,000 yen for 2,100 yen worth of gifts.

Not really worth the hassle. Generally speaking, the higher your income, the more beneficial Furusato Nozei will be to you.

Conclusion

Furusato Nozei is a very unique and beneficial system that everyone should take advantage of. The only “downside” of this is the 2000 yen cost, but benefits will likely outweigh the cost for most.

Tagged guide japan life tax