This website is made possible by readers. I may earn a small commission when you buy through the links in this article at no extra cost to you. Learn more.

Income tax in Japan is based on a marginal tax rate. This means that you are taxed at a higher rate, the higher your income is.

This is the tax rate based on annual income.

| Taxable Income (yen) | Tax Percentage | Deductible Amount (yen) |

| Under 1.95M | 5% | 0 |

| 1.95M-3.30M | 10% | 97,500 |

| 3.3M-6.95M | 20% | 427,500 |

| 6.95M-9M | 23% | 636,000 |

| 9M-18M | 33% | 1,536,000 |

| 18M-40M | 40% | 2,796,000 |

| Above 40M | 45% | 4,796,000 |

The deductible amount in the table is the amount of relief you get, or in other words, you won't get taxed on that amount. For example, if your taxable income is 4M yen, you get a 427,500 yen relief.

Therefore, only 3,572,500 yen will be in the 20% bracket. Or more specifically, the tax is applied marginally. This means only the portion above each threshold is taxed at that rate. So, for a taxable income of 3,572,500 yen:

- 1,950,000 yen will be taxed at 5%

- 1,350,000 yen will be taxed at 10%

- 77,500 yen will be taxed at 20%

For a total of 97500 + 135000 + 15500 = 248000 yen which is about 7% of the original amount, thanks to the marginal aspect of it.

How to find taxable income in Japan?

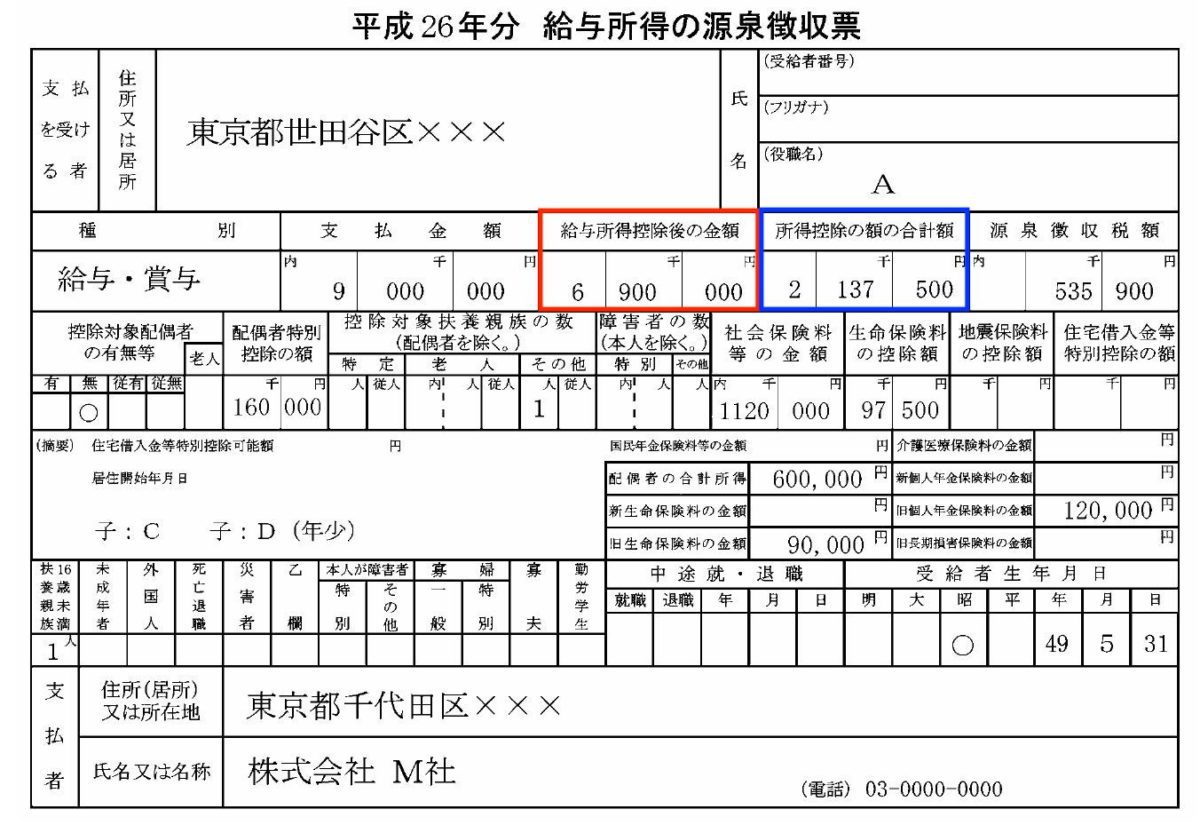

To get your taxable income, you can look at your year-end salary slip (給与所得の源泉徴収票), which is the slip that your company's finance will send to you along with your December salary slip.

On it, you will see two values, Income After Deductions (給与所得控除後の金額) and to the right of to it, Total Income Tax Deductions Amount (所得控除の額の合計額)

To get your taxable income to get the income tax percentage, you have to subtract the Total Income Tax Deductions Amount (in blue above) from Income After Deductions (in red above).

For example, if your Income After Deductions is 4,260,000 yen and Total Income Tax Deductions Amount is 1,860,000 yen, then your taxable income is:

4,260,000 – 1,860,000 = 2,400,000 yen which puts you in the 10% tax bracket based on the above table.

This used to be an ad.

But no one likes ads, so I got rid of them. If my articles helped you, I ask for your support so I can continue to provide unbiased reviews and recommendations. Every cent donated through Patreon will go into improving the quality of this site.

Tagged tax